For young people starting off on their own, paying your own expenses can feel overwhelming. Saving money for retirement can seem way out-of-reach: “I’ll wait till I can afford it.”

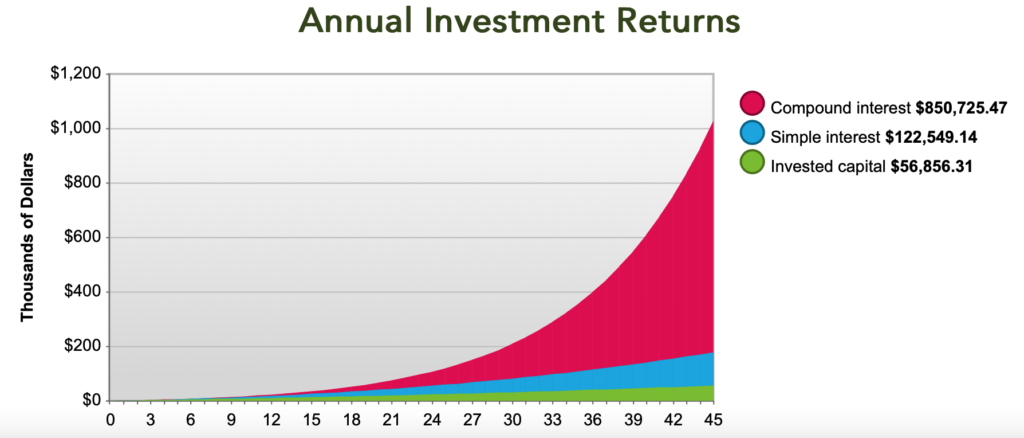

How sad! Waiting can cost you a huge return on even a small investment. Imagine that a 20 year old woman decides to give up two Frappuccinos a week (or skips paying for lunch out once a week). She invests the equivalent (about $15 a week) in a mutual fund comprised of large company stocks. If the market performs in next 45 years as it has for the last 50, when she turns age 65, the $15 a week that she saved will have grown to $1,030,131! (See the detailed explanation below)

Giving up small things and investing the savings wisely is the easiest way to become a millionaire. It’s called “the miracle of compounding.” When money grows at an average annual rate faster than 10%, it only take 7 years to double. Money a twenty-year-old invests in the stock market could double 6 times by retirement age. Consider the growth of the first $1,000 invested if it doubles 6 times:

$1,000 grows to $2,000,

$2,000 grows to $4,000

$4,000 grows to $8,000

$8,000 grows to $16,000

$16,000 grows to $32,000

$32,000 grows to $64,000

Every 7 years you wait costs you a doubling, so get started now! If you can trim $15 a week from your spending and invest it wisely, the benefits will be huge. If you’d like help learning about investing, sign up for a free consultation at FuturePlan Financial. As a nonprofit organization, we can give modest-income people financial coaching and investment advice for a greatly-reduced cost (Starting at $40 a month).

Details:

This projection assumes that her savings are invested in a tax-free Roth IRA retirement account and that 100% of the funds are invested in stock market mutual fund tracking the S & P 500. Over the last 50 years, the stocks contained in the S & P 500 (the 500 largest U.S. companies) have collectively grown at annual average rate of 10.75%. If $780 a year ($15 a week) were to be invested in a low fee index fund equivalent of the S & P 500 at the same rate of growth and the initial annual contributions of $780 a year were increased to match a 2% annual rate of inflation, in 45 years the retirement account would be worth $1,030,131! (According to https://www.federatedhermes.com/us/calculators/InvestmentReturn.html)